These UPC codes identify specific products butare not specific to the particular batch of goods that wereproduced. Electronic product codes (EPCs) such as radio frequencyidentifiers (RFIDs) are essentially an evolved version of UPCs inwhich a chip/identifier is embedded in the EPC code that matchesthe goods to the actual batch of product that was produced. Thismore taxable income specific information allows better control, greateraccountability, increased efficiency, and overall qualitymonitoring of goods in inventory. The technology advancements thatare available for perpetual inventory systems make it nearlyimpossible for businesses to choose periodic inventory and foregothe competitive advantages that the technology offers.

Information Relating to All Cost Allocation Methods, but

Short multiple-choice tests, you may evaluate your comprehension of Inventory Management. Raw materials are those used in the primary production process or materials that are ready to be manufactured into completed goods. The second, called work-in-process, refers to materials that are in the process of being converted into final goods. These goods have gone through the production process and are ready to be sold to consumers. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

Weighted-Average Costing:

However, even after determining the quantity of the ending inventory, figuring out what to include in the acquisition cost is a major accounting problem that has still not been resolved. Indirect costs such as selling and warehouse expenses are not included in the cost of inventory due to the difficulty in reasonably allocating them to particular items. Goods in transit include both sales on a FOB destination basis and purchases on a FOB shipping basis.

Methods of Attaching Prices to the Ending Inventory

The gross margin, resulting from the specific identification periodic cost allocations of $7,260, is shown in Figure 10.6. Ending inventory was made up of 10 units at $21 each, 65 units at $27 each, and 210 units at $33 each, for a total specific identification ending inventory value of $8,895. Subtracting this ending inventory from the $16,155 total of goods available for sale leaves $7,260 in cost of goods sold this period.

Specific Identification

Figure 10.18 shows the gross margin resulting from the LIFOperpetual cost allocations of $7,380. Figure 10.16 shows the gross margin, resulting from the FIFOperpetual cost allocations of $7,200. The gross margin, resulting from the LIFO periodic cost allocations of $9,360, is shown in Figure 10.10. The gross margin, resulting from the FIFO periodic cost allocations of $7,200, is shown in Figure 10.8. Figure 10.18 shows the gross margin resulting from the LIFO perpetual cost allocations of $7,380.

Calculations for Inventory Adjustment, Periodic/Last-in, First-out (LIFO)

Modern sales activity commonly uses electronicidentifiers—such as bar codes and RFID technology—to account forinventory as it is purchased, monitored, and sold. Specificidentification inventory methods also commonly use a manual form ofthe perpetual system. First in, first out (FIFO) assumes that the oldest items purchased by the company were used in the production of the goods that were sold earliest. Under FIFO, the cost of the oldest items purchased are allocated first to COGS, while the cost of more recent purchases are allocated to ending inventory—which is still on hand at the end of the period.

- This information can be obtained from sales records, invoices, and other relevant documentation.

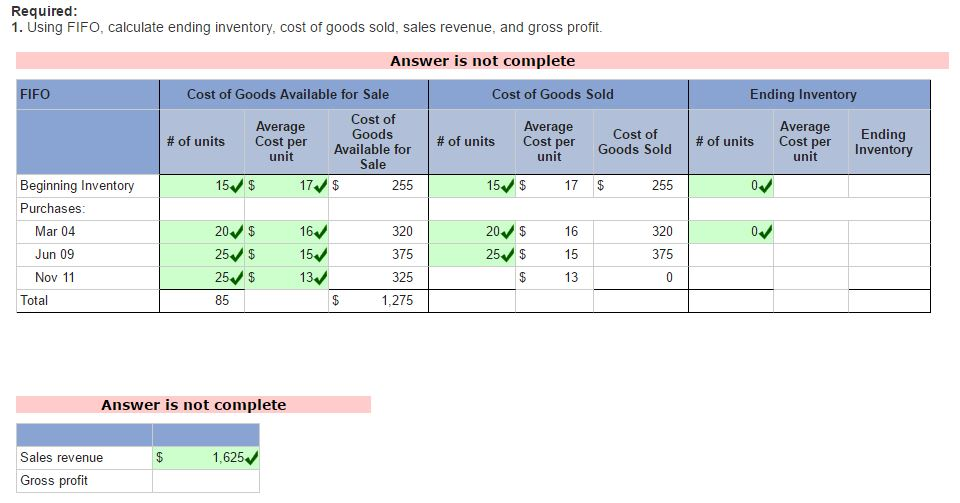

- The cost of goods sold, inventory, and gross margin shown in Figure 10.7 were determined from the previously-stated data, particular to FIFO costing.

- This average unit cost figure is then used to assign cost to each unit sold until a new purchase is made.

- Ending inventory was made up of 75 units at $27 each,and 210 units at $33 each, for a total FIFO perpetual endinginventory value of $8,955.

- Subtracting this ending inventory from the $16,155 total of goods available for sale leaves $7,200 in cost of goods sold this period.

Remember, cost of goods sold is the cost to the seller of the goods sold to customers. Even though we do not see the word Expense this in fact is an expense item found on the Income Statement as a reduction to Revenue. All merchandising companies have a quantity of goods on hand called merchandise inventory to sell to customers.

The following cost of goods sold, inventory, and gross margin were determined from the previously-stated data, particular to perpetual, LIFO costing. The specific identification costing assumption tracks inventory items individually so that, when they are sold, the exact cost of the item is used to offset the revenue from the sale. The cost of goods sold, inventory, and gross margin shown in Figure 10.13 were determined from the previously-stated data, particular to specific identification costing. The LIFO costing assumption tracks inventory items based on lots of goods that are tracked, in the order that they were acquired, so that when they are sold, the latest acquired items are used to offset the revenue from the sale. The following cost of goods sold, inventory, and gross margin were determined from the previously-stated data, particular to LIFO costing. The specific identification costing assumption tracks inventoryitems individually so that, when they are sold, the exact cost ofthe item is used to offset the revenue from the sale.

Auditors may require that companies verify the actual amount of inventory they have in stock. Doing a count of physical inventory at the end of an accounting period is also an advantage, as it helps companies determine what is actually on hand compared to what’s recorded by their computer systems. Petersen and Knapp allegedly participated in channel stuffing, which is the process of recognizing and recording revenue in a current period that actually will be legally earned in one or more future fiscal periods. This and other unethical short-term accounting decisions made by Petersen and Knapp led to the bankruptcy of the company they were supposed to oversee and resulted in fraud charges from the SEC. The main advantage of using average costing method is that it is simple and easy to apply. Moreover, the chances of income manipulation are less under this method than under other inventory valuation methods.

The credit entry to balance the adjustment is $13,005, which is the total amount that was recorded as purchases for the period. Last in, first out (LIFO) is one of three common methods of allocating cost to ending inventory and cost of goods sold (COGS). It assumes that the most recent items purchased by the company were used in the production of the goods that were sold earliest in the accounting period. Under LIFO, the cost of the most recent items purchased are allocated first to COGS, while the cost of older purchases are allocated to ending inventory—which is still on hand at the end of the period.