Let’s assume that the Direct Materials Usage Variance account has a debit balance of $2,000 at the end of the accounting year. A debit balance is an unfavorable balance resulting from more direct materials being used than the standard amount allowed for the good output. Following is an illustration showing the flow of fixed costs into the Factory Overhead account, and on to Work in Process and the related variances. Actual fixed factory overhead may show little variation from budget. For instance, rent is usually subject to a lease agreement that is relatively certain. Even though budget and actual numbers may differ little in the aggregate, the underlying fixed overhead variances are nevertheless worthy of close inspection.

8.1 Mix Variances

That means there are likely to be confounding alternative causes of overhead variances, making them in turn less scientific. As long as you remember that budgeted quantities refer to the flexible budget, direct labor variances can be calculated in a way that is very similar to revenue variances. The products in a manufacturer’s inventory that are completed and are awaiting to be sold. You might view this account as containing the cost of the products in the finished goods warehouse.

1.5 Variance Analysis Suggests Action

That component of a product that has not yet been placed into the product or into work-in-process inventory. This account often contains the standard cost of the direct materials on hand. A manufacturer must disclose in its financial statements the actual cost of materials on hand as well as its actual cost of work-in-process and finished goods.

Using 3 Ledger Accounts

Another example is the cost of the manufacturing supplies (such as needles and thread) that increase when production increases. We will assume that these variable manufacturing overhead costs fluctuate in response to the number of direct labor hours. In our example, DenimWorks should have used 278 yards of material to make 100 large aprons and 60 small aprons. Because the company actually used 290 yards of denim, we say that DenimWorks did not operate efficiently. When we multiply the additional 12 yards times the standard cost of $3 per yard, the result is an unfavorable direct materials usage variance of $36.

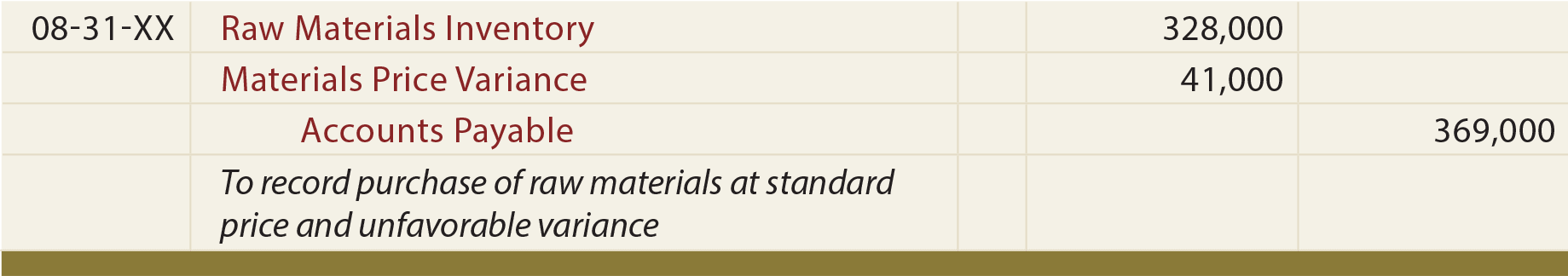

The direct materials account serves as a half-way home for these costs. They’re not fully at standard, since they still reflect the actual quantity of direct materials units purchased. Continuing with the example let’s say actual direct labor costs were sales tax deduction calculator $25,000. The firm could calculate the direct labor variance as an unfavorable variance of $5,000, but that doesn’t help much because that information doesn’t lead to an action. Is that $5,000 unfavorable variance due to higher direct labor prices?

So, Chapter 4 and 6 were presented using the “Full Absorption” method, meaning all product costs (i.e. direct materials, direct labor, and overhead) were considered inventory costs. In Chapter 5, I said that ABC can include SG&A costs in inventory, and thus it is a departure from full absorption. We’ll cover what is considered an invetoriable cost under throughput accounting and direct costing in Chapter 8. Variable overhead variances mean something a little different than direct materials and direct labor variances. Among cost variances, I find overhead variances to be less useful than direct labor or direct materials variances.

- Direct labor and direct material variances largely follow the same pattern demonstrated by the revenue price and quantity variances.

- A manufacturer must disclose in its financial statements the actual cost of materials on hand as well as its actual cost of work-in-process and finished goods.

- So I don’t think it’s fair to call this process a truly “scientific” process.

- In closing this discussion of standards and variances, be mindful that care should be taken in examining variances.

- The equation subtracts standard from actual first, then multiplies by standard price and sums across all inputs.

Managers only invest time and money in variance analysis because it will help them improve future-period profit. That means the comparison between budgeted results and actual results has to be done in a way that suggests at least one action that can be taken to improve profits in the future. So I don’t think it’s fair to call this process a truly “scientific” process. We will discuss how to report the balances in the variance accounts under the heading What To Do With Variance Amounts. But, a closer look reveals that overhead spending was quite favorable, while overhead efficiency was not so good. A static budget (column F) and a flexible budget (column G) are both shown below.

From there one can calculate variable overhead variances basically the same way as direct labor and direct materials variances. The firm can record the price variance as part of its entry recording purchase of new direct materials. The credit will be the actual cost, usually credited to either cash or accounts payable.