You’ll choose your company structure (C corporation, limited liability company, or subsidiary) and pick a company name. Our instant company name checker will let you know if it’s available ccorp meaning before you submit your application. You can add up to four additional cofounders, decide how you split equity between them, and reserve an equity pool for future teammates if you choose.

C-Corps vs. Other Entity Types

A corporation is legally independent of the owners, so in the case of a problem or a lawsuit, the shareholders, directors, and officers cannot be held personally liable. There is still a possibility, though, that the owner can become personally liable with their assets. C corps issue shares of stock to raise capital, which can be publicly traded on a stock exchange. Shareholders invest in the corporation and own a portion of the company proportional to their number of shares.

Limited partnership

As we mentioned, a C-corporation is the standard type of corporation—in other words, it’s an independent legal entity that exists separately from the business owners. A corporation is formed by articles of incorporation submitted to a state agency in charge of corporate filing. These articles include https://www.bookstime.com/ the number of authorized shares along with other basic information about the corporation and its incorporating entities. The corporation-to-be must also designate a registered agent and reserve a name. Check out this article to learn more about the many requirements for starting a business.

Best California registered agent services in 2024

Whether you use an S corp or C corp depends entirely on your situation and business goals. The third way, which is the most convenient, is through a statutory conversion. These are all statutory transactions and you will have to comply with what the corporation statute says. For more information on BOI reporting requirements and on the Corporate Transparency Act, download our BOI fact sheet or visit our Corporate Transparency Act knowledge center.

- The choice between forming an S corp or a C corp will depend on the specific needs and goals of the business, including tax considerations, number and types of shareholders, and desired ownership structure.

- Corporations are taxed as C-corps by default, but some corporations can elect S-corp taxation instead.

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

- Also, S Corp should be chosen by owners who want to avoid double taxation and benefit from tax advantages and deductions.

- Let’s say you want to scale up your coffee shop business so it has a regional or national presence.

- Finally, if you think a C-corp might be right for your business, you’ll want to know how to form one.

- C-corp is a tax classification that is available to both corporations and LLCs, though it is more typically used by corporations.

- The word “corporation” may be thrown around casually as a synonym for a big business, but there’s quite a bit more to it than that.

- Unfortunately, not everything about C corporations is a perk—but what in life is?

- These are exclusively taxed at the individual level and do not permit the selling of stock, the presence of shareholders or business partners, or any responsibility limits.

- Overall, corporations are more regulated than many other types of business structures.

- This could be helpful if a company needs to raise money by selling shares.

Our partners cannot pay us to guarantee favorable reviews of their products or services. Ask a question about your financial situation providing as much detail as possible. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- S Corps cannot provide different classes of stock, and shareholders have the same rights and privileges.

- Profits—and losses, as well—trickle down and pass through to shareholders, who must then report them on their own personal tax returns.

- C-corp shareholders are also afforded the full liability protections of any corporation.

- For example, if a C corp is sued for breach of contract, the plaintiff can collect damages from the corporation’s assets only, not from the personal assets of the shareholders.

- While a C corporation brings many benefits, there are some downsides that you should consider.

How To Start a C Corporation: Advantages & Disadvantages

- The corporation-to-be must also designate a registered agent and reserve a name.

- Despite that, they are still separate entities from the business, so these individuals generally cannot be sued or be at risk for actions taken by the company.

- If the corporation behaves recklessly or fraudulently, then shareholders without separation can be held liable as well—and their personal assets, such as their homes, are at risk of being seized.

- As a legal entity, a corporation is distinct from its shareholders, and shareholders enjoy the same personal liability protection that members of an LLC receive.

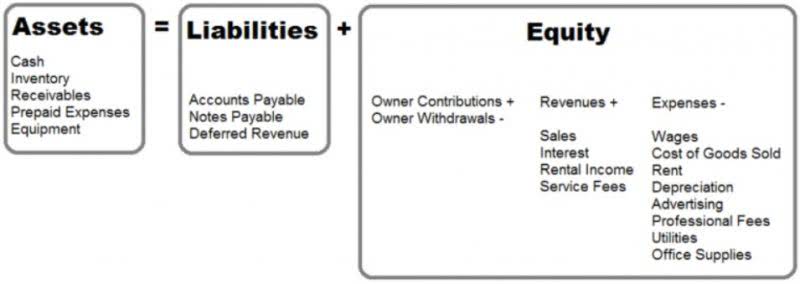

- The C corp entity itself is subject to corporate income taxation, while shareholders are subject to personal taxation.

- For example, if a shareholder of a C corp engages in fraud, embezzlement, or other illegal activities, they may be personally liable for any damages or losses incurred by the corporation or its stakeholders.

- Unlike C corps, LLCs are owned by a single owner or a group of owners.

Pros and cons of a C corporation

How Do I Pay Myself From My Business?